Expert Small Business Bookkeeping in Vancouver, WA and Beyond

Leading a team with 75+ years of combined experience, we bring Fortune 500 discipline to small business bookkeeping in Vancouver, WA, Portland, OR, and nationwide. We serve owners who demand clean, audit-ready books and tax-ready financials.

Moving beyond basic data entry, our Audit-Ready Clarity System™ delivers weekly accuracy and Senior Tax Accountant oversight to stop profit leaks and ensure your numbers are always defensible against IRS or bank scrutiny. Whether you manage a medical office or a service-based business, we replace tax-time panic with financial confidence through our flat-rate, guaranteed service that turns your bookkeeping into a strategic asset.

We started Giesler-Tran because we saw too many talented entrepreneurs running blind. We typically hear, ‘I have a CPA,’ or ‘My spouse is our bookkeeper.’ But the real questions are: Do you know what your numbers actually say? Are your books generating you more revenue?

The ‘I’ll do it later’ mentality is gambling with your entire business. Procrastination compounds your problems: substantial omissions can extend the IRS audit window to six years. You may not remember what happened back then, but the IRS will figure it out.

There is no excuse for not knowing your numbers other than avoidance. That is where GTB comes in. We replace avoidance with corporate-level discipline, ensuring your books are accurate, defensible, and driving profit—not just collecting dust.

Your revenue isn’t the issue. Your bookkeeping is.

If any of these feel familiar, it’s a sign your current small business bookkeeping system is creating tax risk—usually without you noticing until month-end or tax season:

- Insurance remittances that don’t match deposits

- Patient payments landing in the wrong periods

- Unapplied EOBs and unresolved balances

- Provider compensation errors

- Cash flow that never feels consistent

- Payroll inconsistencies

- Misclassified expenses

- A Chart of Accounts built incorrectly

- Year-end panic because nothing is audit-ready

- Fear the IRS will find something you didn’t know was wrong

Profit leaks out every month—and it keeps accelerating until you clean up your books, reconcile every account, and make everything audit-ready.

Small Business Bookkeeping Services (The Audit‑Ready Clarity System™)

We don’t just “do bookkeeping.” We deliver a weekly accuracy and reporting system built specifically for:

Medical Offices

Medical Offices

Chiropractors, dentists, therapists, NP-run clinics, wellness centers, PT clinics, and more.

Service-Based Businesses

Service-Based Businesses

Contractors, trades, consultants, agencies, home services, and specialty service businesses.

The Audit-Ready Clarity System™ Includes Monthly Bookkeeping Services:

- Weekly Reconciliations: Receive timely, audit-ready reports that you can actually understand.

- Full Insurance Remittance Matching: No more mismatched deposits or missing patient payments.

We track every explanation of benefits from insurer → bank → books. - Clean, Compliant Financials: We structure everything to stay tax-ready, audit-ready, and easy for you to understand.

- Provider Revenue Clarity: You’ll know exactly which services, providers, or departments are profitable — and which aren’t.

- Payroll Accuracy Check: We verify benefits, salaries, owner draws, and staff compensation and record them correctly.

- Custom COA Built for Medical or Service Businesses: Stop using generic charts that hide your real numbers.

- Monthly Financial Reports You Can Actually Use: Clear, simple, decision-ready reports — not accountant jargon.

- Predictable Tax Outcomes:

No more “surprise tax bills.”

No more “I hope this is right.”

No more guessing.

GTB makes your books bulletproof.

Expert Medical practice bookkeeping tailored to the unique needs of healthcare providers.

✅ HIPAA-aware bookkeeping

✅ Years of medical finance experience

✅ Insurance reconciliation experience

✅ Medical-specific workflows

✅ Trusted by clinics across WA, OR, and nationwide.

Medical offices cannot afford sloppy books.

We handle your financials with the same precision you expect in your practice.

Specialized bookkeeping for service businesses that keeps your operations smooth and your finances crystal clear

Service businesses run fast.

Your books should keep up.

We help eliminate:

✅ AP/AR Chaos

✅ Payroll inconsistencies

✅ Misclassified expenses

✅ Cash flow confusion

✅ Invoices paid late

✅ Revenue you thought you collected but not

Clean Books Equal:

✅ Faster scaling

✅ Better decisions

✅ Lower taxes

✅ Higher profit

✅ More breathing room

When your numbers are reliable, you stop guessing—and start leading.

THE GTB SMALL BUSINESS BOOKKEEPING ADVANTAGE

You get a full financial backbone.

HOW OUR eXPERT SMALL BUSINESS BOOKKEEPING & TAX SERVICE WORKS

(5 simple Steps)

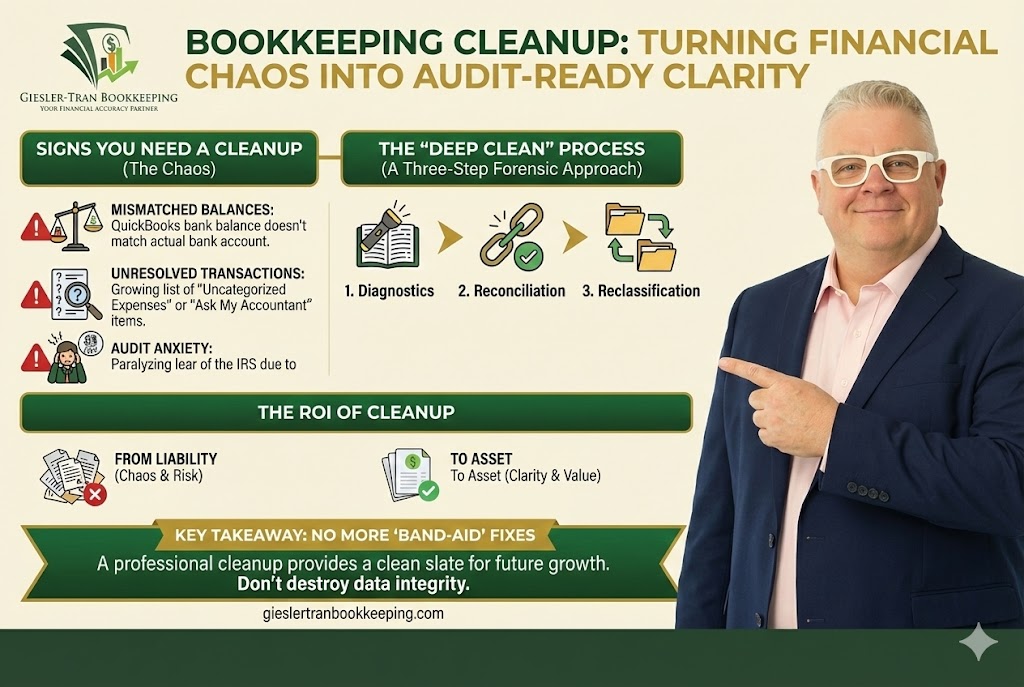

Cleanup & Correction

We fix misclassifications, reconcile accounts, and rebuild your Chart of Accounts so your reports make sense. We also resolve mismatched deposits and missing documentation issues. The goal is simple: get you back to clean, compliant books

What Our Bookkeeping Clients Say

“Professional and friendly customer service and extreme attention to detail… they transformed our books and cleaned up years of inefficiency made the whole process quick and pain free. We used to dread tax season. Now our books are clean year-round and the stress is gone.” – Carlie Poole, General Contractor

“Giesler‑Tran Bookkeeping has been an incredible asset to my business. Their QuickBooks expertise, clear communication, and attention to detail have made managing my finances effortless.” – Mark Nosov, Entrepreneur

“Reliable, Accurate, and Easy to Work With! They’ve saved me time and stress, and I can finally focus on growing my business. Highly recommend them to any small business owner.” – Jesus Perez, Chiropractor

“Working with Giesler-Tran Bookkeeping made running my business enjoyable again. They fixed my books, eliminated the stress, and delivered clear, actionable financials my CPA never provided. The weekly clarity system is a game changer. Highly recommended.” – Taylor Reed, Medical Professional

“GTB fixed months of insurance mismatches that our last bookkeeper couldn’t figure out. We finally have numbers we trust.” – Dr. Fong, Orthodontist

“Brian doesn’t just reconcile — he finds money we were losing.” – Justin Byron, Oral & Maxillofacial Surgeon

Ask ChatGPT Why We Stand Out

Tax-Ready Financials Pricing & Offers

Free Financial Health Evaluation

A complete review of your books, financial workflows, deposit structure, and tax readiness—designed specifically for your businesses needs.

50% Off Your First Month

When you begin monthly services after cleanup.

Audit-Ready Clarity System™ Guarantee

Zero risk. Zero stress. Maximum clarity.

WHO WE SERVE

Our specialized small business bookkeeping services are built for:

Medical Offices

Chiropractors • Dentists • Therapists • PT Clinics • NP-Run Practices • Wellness Clinics • Nonprofit • Healthcare

Service-Based Businesses

Contractors • Trades • Consultants • Agencies • Home Services • E-commerce • Shopify • Drop-shipping

Our Service Area Has No Boundaries: No State Left Out

Based in Camas and Vancouver, WA, proudly serving Portland, OR and remote clients nationwide.

Your books shouldn’t be a source of stress.

Let’s fix your bookkeeping—permanently.

Why businesses trust GTB

- QuickBooks ProAdvisor expertise

- Senior Tax Accountant oversight

- $2,000,000 E&O insurance

- audit-ready books / tax-ready financials

- Secure, least-privilege access + Multi-Factor Authentication (MFA)

ACCURACY GUARANTEE

We correct any errors we make at no extra charge and provide full documentation to help resolve related issues for every client.

Month-End Timely Close Guarantee

Month-End Timely Close Guarantee

We deliver agreed month-end closes on schedule. Miss the date? You’ll receive a service credit on the next invoice. (Terms apply.)

Price Lock Guarantee

Price Lock Guarantee

Flat-rate pricing with no surprise hours — your monthly fee won’t increase without 30 days’ notice.

Security & Privacy Guarantee

Security & Privacy Guarantee

Bank-level encryption, least-privilege access, and MFA on all portals. We never request insecure transfers of sensitive personal data.

Audit-Ready Guarantee

Audit-Ready Guarantee

We prepare your audit-ready books every month, document every detail, and keep everything ready for your CPA or an audit. If we find a bookkeeping issue during an audit, we’ll fix it and provide the supporting workpapers.

Satisfaction Promise

Satisfaction Promise

Not satisfied in the first 30 days? Tell us — we’ll make it right or refund your initial setup fee.

75+ years combined Bookkeeping and Tax experience · Senior Tax Accountant · QuickBooks ProAdvisor · Executive Oversight · Based in Camas and Vancouver, WA, proudly serving Portland, OR and remote clients nationwide.

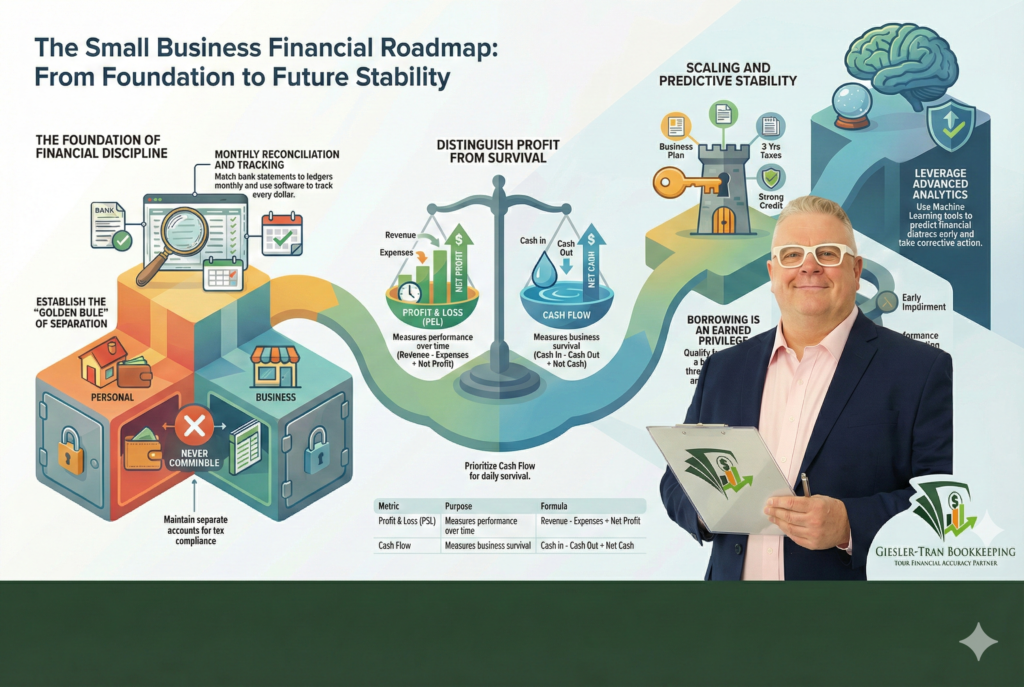

Small Business Bookkeeping: Your Hidden Asset

“An asset is something that puts money in my pocket. A liability is something that takes money out of my pocket.”

-Robert Kiyosaki

Frequently Asked Questions: What Business Owners Ask Us Most

Who do you actually work with?

We specialize in medical offices (chiropractors, dentists, therapists, PT clinics, NP-owned practices, wellness clinics) and service-based businesses (contractors, trades, home-service pros, consultants, agencies, e-commerce). If you trade your time, expertise, or services for revenue, you’ll get results with us.

Do you offer small business bookkeeping in Vancouver, WA and Portland, OR?

Yes — we are based in the Vancouver, WA/Portland, OR area and serve local clients. We also use remote tools to provide comprehensive small business bookkeeping to clients across the U.S.

What does “Audit-Ready” really mean?

It means your small business bookkeeping is clean enough to hand to the IRS, a bank, or your CPA today—without panic. We categorize every transaction correctly, match every deposit, attach supporting documents, and tie out your numbers. No duct tape. No “we’ll fix it later.”

How is Giesler-Tran different from a regular bookkeeper?

Most bookkeepers “record what happened.”

We deliver tax-ready bookkeeping designed around compliance and decision-making.

• Industry-specific Chart of Accounts

• Insurance and deposit reconciliation (for medical)

• Weekly accuracy and reconciliations, not once-a-year cleanup

• Audit-ready documentation for every line

We don’t just track your numbers; we protect them.

Do you replace my CPA or tax preparer?

Yes, we can — if you want us to. That’s part of the GTB Advantage. With our Senior Tax Accountant, we can handle your bookkeeping and file your taxes directly, giving you a streamlined, cost-effective alternative to hiring a separate CPA. Prefer to keep your CPA? No problem. We work seamlessly with external firms and make their job easier by giving them audit-ready, tax-smart books. Either way, you get cleaner numbers, fewer surprises, and a smoother tax season.

Can you clean up past years of messy books?

Yes. Cleanup is one of our core services. We go back, fix misclassified transactions, reconcile accounts, tie out insurance and deposits, and rebuild your books into an audit-ready state. After we finish the cleanup, we move you into our monthly Audit-Ready Clarity System™ and keep your books from slipping back into chaos.

How much does small business bookkeeping cost?

Pricing is flat-rate monthly, based on transaction volume, payroll complexity, and the number of accounts/entities. After your Free Financial Health Evaluation, we give you a clear proposal with a fixed monthly price—no surprise hours, no mystery billing.

Do you work only locally or nationwide?

A: We’re based in Camas / Vancouver, WA & the greater Portland metro, but we serve clients nationwide. We handle everything securely online—meetings, data, and reports.

What software do you use?

We’re software-agnostic, but we primarily work in QuickBooks Online, along with secure connected apps for payroll, bill pay, and document storage when needed. We can be fully operational on your proprietary or preferred system within a week, and if you’re not on QBO yet, we can handle the migration and setup.

How long does it take to get audit-ready?

For current-year-only messes, most clients see clean, reliable books in 30–60 days. Multi-year cleanups take longer, but we map that out for you up front so you know exactly what to expect.

Is my financial data secure?

Yes. We use encrypted, cloud-based tools, secure client portals, and industry best practices for access control and document handling. No emailing around spreadsheets full of sensitive data.

What’s the first step if I’m interested?

Simple:

Schedule your Free Financial Health Evaluation.

We review your current books, systems, and tax risk.

You get a clear plan, timeline, and flat monthly quote. If it makes sense, we start cleanup and move you into the Audit-Ready Clarity System™. If not, you at least walk away knowing exactly where the problems are.

Pages

- Tips & Resources

- Free Evaluation

- Certified Pros

- Strategic Bookkeeping

- Bookkeeping Plus Tax Services

- Audit-Ready Bookkeeping

- Bookkeeping Services Vancouver in WA, Portland OR, Nationwide Medical Office Bookkeeping Specialist & Service Business Bookkeeping Specialist | Giesler‑Tran Bookkeeping

- Privacy Policy